Unveiling the Extraordinary: Saving Challenges and Freebies

Table of Contents

- Introduction

- A Wild Day of Errands

- The Savings Challenges

- Fall Mini Roll Challenge

- Gobble Till You Wobble Challenge

- The Importance of Saving

- New Challenges in the Shop

- Personal Goals for the Next Year

- Budgeting and Saving for Future Events

- How I Use My Money

- Paying Off the Mortgage

- The Results of the Challenges

- Setting Goals for January 2024

- Surprise for the Viewers

- Conclusion

A Wild Day of Errands

Introduction

Good morning everyone! This is Lisa from [channel name]. Did you miss me yesterday? I certainly missed you. I had a wild day running errands. Let me tell you all about it.

Yesterday, my son's car broke down, so I had to drive him about an hour away to his job site. After dropping him off, I went straight to my parents' house to help clean up and take my mom to her doctor's appointment. Since it was too late to go back home and then drive back to pick up my son, I decided to spend the night at my mom's place. We had a productive day, wrapping Christmas presents and getting everything ready for the holidays. I always enjoy spending time with my mom and dad, so it was a wonderful day overall.

The Savings Challenges

On Wednesdays, I usually do my big savings challenges, but I didn't get the chance to do that yesterday. However, today I will be doing the Fall Mini Roll Challenge from Lady D saves and the Gobble Till You Wobble Challenge. These are my last two challenges associated with either Thanksgiving or fall.

The Fall Mini Roll Challenge requires me to save $25 increments, and the Gobble Till You Wobble Challenge is a fun way to save money for our Thanksgiving dinner. My daughter-in-law, who is an ICU nurse, works around her schedule, so we need to finish these challenges today to pay for our family dinner.

Let's see how much money I have saved in each challenge.

Fall Mini Roll Challenge: I currently have $150 saved, and I need to add $125 to complete the challenge. This money will go towards our Thanksgiving dinner.

Gobble Till You Wobble Challenge: I have $400 saved in this challenge. The money from both challenges, along with the additional money I have set aside, will cover the cost of our entire family going out to eat. We're all looking forward to this special meal together.

The Importance of Saving

I've been doing a lot of thinking about next year and evaluating how I manage my finances. I believe it's essential to make the best decisions for me and my family. In the coming year, we have several significant events - my son's high school graduation, a family trip, ongoing medical expenses - that require financial planning. Additionally, we have home repairs and personal goals we want to save for.

Currently, my husband covers all our monthly bills and necessities with his paycheck, while the money I make from my Etsy shop and YouTube channel is set aside for extras and additional savings.

Paying off our mortgage is a top priority for me, as it provides security and allows us to allocate more funds to other areas of our lives. I want to ensure we have a comfortable future and enough money for emergencies and unexpected expenses.

Overall, my goal is to reach financial stability, save for our retirement, and build a healthier financial future for my family.

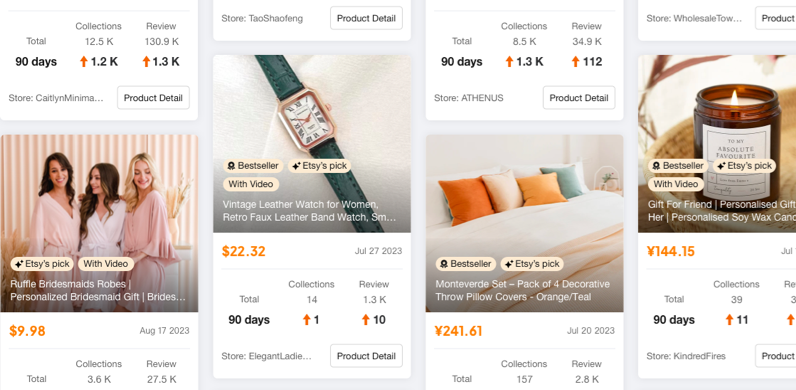

New Challenges in the Shop

I'm thrilled to announce that we have some exciting new challenges available on my Etsy shop, Happy Mailbox Code. We have recently added the "Roll and Save" challenges, and I have three more challenges coming up soon. These challenges are perfect for anyone looking to make saving money a fun and engaging experience.

Personal Goals for the Next Year

As we approach the new year, my husband and I have discussed our financial goals for 2024. These include saving for specific events such as graduation and holidays, as well as building an emergency fund, medical savings, and retirement savings. Our total savings goal for next year is $15,500.

We understand that these goals will require careful budgeting and dedication, but we're committed to achieving them. Our focus is on creating a secure financial foundation for ourselves and future generations.

Budgeting and Saving for Future Events

Planning for the future events in our lives, such as graduations, family vacations, and medical expenses, is essential. By creating a detailed budget and setting aside money each month, we can ensure that these events are financially manageable and less stressful.

It's important to allocate funds for these events well in advance, allowing us to enjoy these special moments without the burden of unexpected expenses. Whether it's saving for our children's milestones or taking care of our own health needs, having a concrete plan in place helps us feel more secure and prepared.

How I Use My Money

Throughout my life, I've been blessed to be a stay-at-home mom, and now a stay-at-home grandma, allowing me to focus on my family's needs and spend quality time with loved ones. My husband's paycheck covers all our essential expenses, such as mortgage, utilities, and subscriptions. The money I earn from my business ventures, including Etsy and YouTube, is reserved for additional savings, extra medical expenses, and fulfilling personal desires.

We live a modest lifestyle, and sometimes it feels like we're living paycheck to paycheck. However, we value the opportunity to save and invest in our future. By carefully managing our finances, we can prioritize our family's well-being and work towards financial stability.

Paying Off the Mortgage

One of my top financial priorities is paying off our mortgage. I strongly believe that once we free ourselves from the burden of monthly mortgage payments, we gain financial freedom and the ability to address other financial needs more efficiently.

By directing the majority of my earnings towards paying down the mortgage, we aim to eliminate this substantial debt and create a solid foundation for future endeavors. We want to be prepared for any possible financial challenges that may arise and secure our family's future.

The Results of the Challenges

Now, let's take a look at the results of the savings challenges that I completed today. In the Fall Mini Roll Challenge, I saved $150, and in the Gobble Till You Wobble Challenge, I saved $400. These savings, along with additional funds I had set aside, allowed us to cover the cost of our Thanksgiving dinner. It's truly satisfying to see how saving money in small increments adds up over time.

Setting Goals for January 2024

As we step into the new year, my husband and I have established some financial goals for January 2024. Our primary focus is to save a specific amount to cover all our monthly bills, including mortgage, utilities, subscriptions, and other expenses. This ensures that we have one month's worth of bills saved in case of any emergencies or financial setbacks.

Additionally, we aim to grow our emergency fund and medical savings to provide more security and peace of mind. We have also set aside funds for upcoming events such as our son's high school graduation, Easter, Thanksgiving, and birthdays.

Together, our savings goals for January 2024 total $15,500. Achieving these goals requires discipline and commitment, but we are determined to make it happen.

Surprise for the Viewers

As a token of my appreciation to all the viewers who have supported me and my channel, I have a surprise for you. If you visit my Etsy shop, Happy Mailbox Code, and order five savings challenges, you will receive three additional challenges for free. Simply write "3 free" in the comments section during checkout, and I will include these extra challenges with your order. It's my small way of giving back to this amazing community that has shown me so much support.

Conclusion

In conclusion, life sometimes throws unexpected challenges our way, but through careful planning and disciplined saving, we can overcome them. It's essential to set realistic goals, prioritize our financial needs, and make meaningful decisions that benefit our future.

I am grateful for the opportunities I've had as a stay-at-home mom and grandma, and I aspire to create a stable financial foundation for my family. By paying off our mortgage, focusing on savings, and managing our money wisely, we can navigate any financial obstacles that come our way.

Thank you all for your support, and remember to cheer me on as I work towards my financial goals in the coming year. Have a fabulous day, and I'll see you soon!

Highlights

- Running errands and spending time with family

- The Fall Mini Roll Challenge and Gobble Till You Wobble Challenge

- Reflections on the importance of saving and future financial goals

- New challenges available on the Etsy shop

- Personal goals for next year, including paying off the mortgage

- The results of the completed challenges and savings achievements

- Setting goals for January 2024 and the importance of budgeting

- Surprise offer for viewers in the Etsy shop

- Conclusion and gratitude for the support from the community

FAQ

Q: How many challenges did you complete today?

A: I completed two challenges today: the Fall Mini Roll Challenge and the Gobble Till You Wobble Challenge.

Q: What is the importance of paying off your mortgage?

A: Paying off the mortgage provides financial security and allows for more flexibility in allocating funds toward other areas of life. It is a top priority for me to have a stable living situation and a solid foundation for future financial endeavors.

Q: How do you use the money you earn from your Etsy shop and YouTube channel?

A: The money I make from my Etsy and YouTube endeavors is set aside for extras and additional savings. It allows us to enjoy certain luxuries, save for vacations, and take care of any unexpected medical expenses.

Q: What are your personal goals for next year?

A: My personal goals for next year include saving for upcoming events such as my son's high school graduation, family vacations, and medical expenses. I also plan to allocate more funds towards paying off our mortgage and building a secure financial future.

Q: How do you plan to reach your savings goals for January 2024?

A: To achieve our savings goals for January 2024, we will be diligently budgeting and setting aside specific amounts for each expense category. By managing our finances wisely and staying committed to our goals, we believe we can successfully reach our targets.

WHY YOU SHOULD CHOOSE Etsyshop

WHY YOU SHOULD CHOOSE Etsyshop