The Art of Cash Stuffing: Managing Finances with Limited Income

Table of Contents:

- Introduction

- The New Wallet Design

- Cash Stuffing for Low Income

- Managing Bills and Sinking Funds

- Cash Allocation for Family Members

- Savings Challenges and Envelopes

- Organizing Finances with Envelopes

- Contemplating Further Education

- Benefits of Becoming an MLO

- Conclusion

The Art of Cash Stuffing for a Low Income

Introduction

Welcome back to Busy Budgets! In this article, we will explore the art of cash stuffing for individuals with a low income. Cash stuffing refers to the practice of allocating cash into different envelopes for various expenses such as bills, sinking funds, and savings challenges. It is an effective way to manage finances and ensure that every dollar is allocated to its designated purpose. Whether you're a budgeting newbie or a seasoned pro, this article will provide valuable insights and tips for effective cash stuffing. Let's dive in!

The New Wallet Design

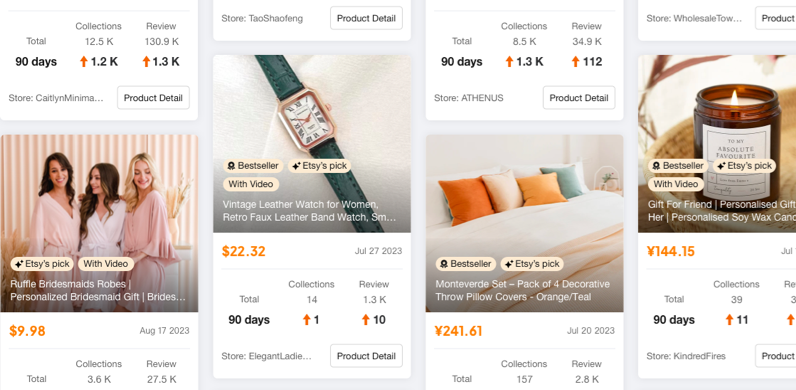

Before we delve into the intricacies of cash stuffing, let's take a moment to appreciate the new wallet design by Busy Budgets. The pebbled A7 wallet is the latest addition to their collection, featuring a classic and spacious design. With ample card holders, a coin zipper, pen holder, and extra pockets, this wallet is both stylish and practical. If you're in the market for a new wallet, be sure to check out Busy Budgets' Etsy shop for this stunning pebbled A7 wallet.

Cash Stuffing for Low Income

Managing finances with a low income can be challenging, but cash stuffing provides a practical solution. By allocating cash into different envelopes, you can ensure that each expense is accounted for and avoid overspending. In this article, we will cover various categories that can be included in your cash stuffing routine, such as rent, mortgage, electricity bills, car payments, and more. We'll also explore strategies for condensing categories to better manage limited funds.

Managing Bills and Sinking Funds

Bills are a crucial part of our financial responsibilities, and cash stuffing can help us stay on top of them. We'll discuss effective ways to allocate cash for bills such as mortgage, electricity, water, and more. Additionally, we'll explore the concept of sinking funds, which involves setting aside money for future expenses like car repairs, vacation funds, or Christmas gifts. By incorporating sinking funds into your cash stuffing routine, you can avoid financial stress when unexpected expenses arise.

Cash Allocation for Family Members

In a household, it's important to consider the financial needs of each family member. We'll discuss strategies for allocating cash to children, spouses, and even parents. From providing allowances for children to assisting spouses with their financial goals, cash stuffing can be a versatile tool for meeting the needs of your entire family.

Savings Challenges and Envelopes

For those looking to boost their savings, cash stuffing can be an effective way to reach financial goals. We'll explore different savings challenges that you can incorporate into your cash stuffing routine, such as saving a specific amount each week or participating in monthly savings challenges. By utilizing specially designed envelopes and tracking your progress, you can stay motivated and make significant strides towards achieving your savings goals.

Organizing Finances with Envelopes

Envelopes play a crucial role in the cash stuffing method, helping to keep finances organized and easily accessible. We'll discuss the best practices for organizing envelopes, labeling them for specific expenses, and maintaining an efficient system. From managing bills to tracking savings, envelopes provide a tangible representation of your financial goals and progress.

Contemplating Further Education

If you're considering furthering your education, we'll explore how cash stuffing can play a role in financing your studies. We'll discuss the benefits of pursuing a degree or certification, the potential career opportunities it can open up, and how to allocate funds for educational expenses. Whether you're contemplating a degree change or advancing your current career, cash stuffing can help you achieve your educational goals without derailing your financial stability.

Benefits of Becoming an MLO

One potential career path that can be financially rewarding is becoming a Mortgage Loan Originator (MLO). We'll delve into the advantages of working in this field, the potential income streams, and the challenges that may come along the way. If you have a knack for sales and enjoy assisting others in achieving their homeownership dreams, becoming an MLO might be the perfect fit for you.

Conclusion

Cash stuffing is a valuable tool for managing finances efficiently, regardless of income levels. By allocating cash into envelopes dedicated to different expenses, you can gain control over your financial situation and achieve your financial goals. Whether you're focusing on bills, savings challenges, or allocating funds for educational pursuits, cash stuffing provides a tangible and practical approach to budgeting. With the tips and insights provided in this article, you can embark on your cash stuffing journey with confidence and financial peace of mind.

Highlights:

- Cash stuffing is a practical solution for managing finances with a low income.

- Allocation of cash into envelopes ensures that each expense is accounted for.

- Strategies for managing bills and sinking funds using cash stuffing.

- Efficient allocation of cash for family members' financial needs.

- Savings challenges and organizing finances with envelopes.

- Harnessing the benefits of cash stuffing for further education.

- Exploring the advantages of becoming an MLO in the mortgage industry.

FAQs:

Q: What is cash stuffing?

A: Cash stuffing refers to the practice of allocating cash into different envelopes for budgeted expenses. It helps individuals manage their finances effectively and ensures that every dollar is allocated to its designated purpose.

Q: How can cash stuffing benefit those with a low income?

A: Cash stuffing allows individuals with a low income to have a clear overview of their expenses and ensures that they stay within their budget. It helps in avoiding overspending and allows for better financial management.

Q: How can I start cash stuffing?

A: To start cash stuffing, you will need envelopes and a budgeting system. Allocate specific amounts of cash to different expenses, such as bills, savings, and sinking funds, and place the appropriate amount of money in each envelope. Update the contents regularly to stay on track with your budget.

Q: Can cash stuffing be used for saving money?

A: Yes, cash stuffing is an excellent tool for saving money. By allocating cash to savings challenges and setting aside money for specific goals, individuals can build up their savings and achieve their financial objectives.

Q: Is cash stuffing suitable for managing family finances?

A: Absolutely! Cash stuffing can be customized to accommodate the financial needs of each family member. By allocating cash to children, spouses, and parents, individuals can ensure that everyone's financial requirements are accounted for.

Q: How does cash stuffing benefit educational pursuits?

A: Cash stuffing can be utilized to save money for educational expenses, such as tuition fees or certification programs. By setting aside funds specifically for education, individuals can pursue their educational goals without compromising their financial stability.

Q: What are the advantages of becoming an MLO?

A: Becoming a Mortgage Loan Originator (MLO) can provide a financially rewarding career. MLOs have the opportunity to help individuals achieve their homeownership dreams and enjoy potential income streams.

Q: Can using envelopes help in organizing finances?

A: Yes, envelopes play a vital role in organizing finances when implementing the cash stuffing method. Properly labeled envelopes allow for easy tracking of expenses and provide a tangible representation of financial goals and progress.

Q: Can cash stuffing work for individuals with fluctuating incomes?

A: Cash stuffing can be adapted to accommodate fluctuating incomes. By adjusting the allocation of cash to different expenses based on available funds, individuals can effectively manage their finances despite income fluctuations.