Top 3 Undervalued Stocks Every Investor Should Watch

Table of Contents

- Introduction

- Overview of the Three Potential Undervalued Stocks

- Analysis of 3M Company

- Overview of 3M Company

- Dividend Yield Analysis

- Financial Performance and Outlook

- Stock Analyzer Tool Analysis

- Analyst Estimates

- Analysis of Etsy

- Overview of Etsy

- Financial Performance and Outlook

- Stock Analyzer Tool Analysis

- Analyst Estimates

- Analysis of C Limited

- Overview of C Limited

- Financial Performance and Outlook

- Stock Analyzer Tool Analysis

- Analyst Estimates

- Conclusion

Three Potential Undervalued Stocks: 3M, Etsy, and C Limited

Investors are always on the lookout for undervalued stocks that have the potential for growth and profitability. In this article, we will be discussing three potential undervalued stocks: 3M Company, Etsy, and C Limited. We will analyze these companies' financial performance, outlook, and use the stock analyzer tool to determine their fair value. Whether you are a beginner or advanced investor, this article will provide valuable insights into these stocks. So, let's dive in and explore the investment opportunities presented by these three companies.

Analysis of 3M Company

Overview of 3M Company

3M is a well-known multinational conglomerate based in Minnesota. The company has recently settled several lawsuits and offers a significant dividend yield of 6.1%. While a high dividend yield may seem attractive, it's important to note that it doesn't guarantee long-term stability. In this analysis, we will delve deeper into 3M's financials and potential risks associated with its dividend payout.

Dividend Yield Analysis

Although 3M's dividend yield is impressive, it's crucial to understand the underlying factors determining its sustainability. The company's dividend of 3.3 billion accounts for 60% of its five-year average free cash flow of 5.4 billion. Additionally, the recent settlements have put additional strain on 3M's cash flow. In the event of further stock price declines, 3M might consider reducing its dividend to ensure stability. Investors should evaluate the risks associated with such high dividend yields before making investment decisions.

Financial Performance and Outlook

Examining 3M's income statement reveals a negative 4.4% profit margin in the last year, which raises concerns about the company's financial health. There was a significant increase in total operating expenses, especially in the SG&A expense category. The negative profit margin is a red flag, indicating a possible downward trend in the company's financial performance. Additionally, 3M's cash flow in the last year was 4.4 billion, with a net income of -1.47 billion. It's essential to investigate the reasons behind these figures and whether they are temporary or indicative of a long-term issue.

Stock Analyzer Tool Analysis

To determine the fair value of 3M stock, we will use the stock analyzer tool. Assuming revenue growth rates of 1%, 3.5%, and 5% and profit margins of 10%, 12.5%, and 15%, we can analyze different scenarios. Based on these assumptions, the stock's fair value ranges from 69 USD to 120 USD, with a middle price of 93 USD. It's important to consider these values alongside your desired return and margin of safety when making investment decisions.

Analyst Estimates

Analysts expect 3M to earn 8.98 USD per share this year, with projected growth to 11.47 USD per share in the next four to five years. While these estimates do not indicate substantial growth, it's worth noting that 3M operates in various industries, making it possible for revenue to increase alongside global income. The company's history demonstrates consistent revenue growth, from 19 billion USD 20 years ago to 33 billion USD today. This long-term growth potential should be considered when evaluating 3M as an investment opportunity.

Analysis of Etsy

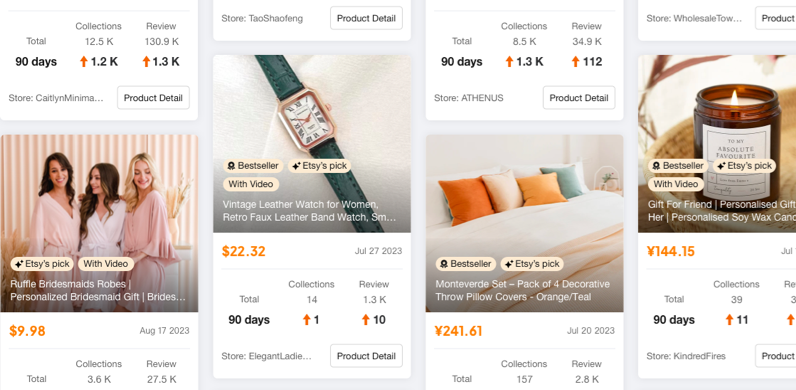

Overview of Etsy

Etsy is a leading e-commerce company known for its unique handmade and vintage goods marketplace. While the company has a high gross margin of 70.6%, it has been losing money in recent years. It's crucial to understand the reasons behind these losses and assess Etsy's long-term growth potential.

Financial Performance and Outlook

Etsy's financial statement reveals consistent losses over the past few years. Despite generating 13 billion USD in revenue last year, the company recorded a net loss of 1 billion USD. While these figures may raise concerns, Etsy has managed to generate positive free cash flow of 674 million USD, indicating underlying profitability. Assessing the reasons behind these income and cash flow discrepancies is crucial in understanding Etsy's financial health.

Stock Analyzer Tool Analysis

In order to determine the fair value of Etsy, we will utilize the stock analyzer tool. By considering revenue growth rates of 3%, 5%, and 10%, and profit margins of 18%, 24%, and 30%, we can assess different scenarios. The analysis reveals a fair price range of 46 USD to 128 USD, with a middle price of 80 USD. It's important to note that Etsy's high growth potential and unique business model justify paying a premium for the stock.

Analyst Estimates

Analysts project significant growth for Etsy, with estimated earnings per share of 2.47 USD this year and 7.73 USD in the next five years. The company's revenue growth is also expected to be impressive, with estimates reaching 4.8 billion USD in 2027. These projections highlight the potential for Etsy to capitalize on its niche market and deliver substantial returns to investors.

Analysis of C Limited

Overview of C Limited

C Limited is the largest e-commerce company in Southeast Asia. While the company has a gross margin of 43% and significant revenue, it has yet to turn a profit. Investors must carefully consider C Limited's financials and growth potential before investing in the company.

Financial Performance and Outlook

C Limited has consistently recorded losses over the years. Despite its large revenue of 13 billion USD, the company reported a net loss of 1 billion USD. Furthermore, C Limited has been diluting shares, which can negatively impact existing shareholders. It's crucial to examine the reasons behind these losses and assess C Limited's long-term profitability.

Stock Analyzer Tool Analysis

Using the stock analyzer tool, we can determine the fair value of C Limited. Based on revenue growth rates of 5%, 10%, and 15%, and profit margins of 13%, 16%, and 19%, the fair price range for the stock is projected to be 46 USD to 128 USD, with a middle price of 80 USD. While C Limited's financial performance raises concerns, the market potential in Southeast Asia and the company's gross margin justify considering it as a potential investment opportunity.

Analyst Estimates

Due to C Limited's current financial situation, analysts do not expect significant growth in earnings per share. However, revenue growth is expected to be substantial, with estimates reaching 4.8 billion USD in 2027. While these projections indicate potential market growth, it's important to consider the risks associated with investing in a company that has yet to turn a profit.

Conclusion

In conclusion, 3M, Etsy, and C Limited are three potential undervalued stocks that offer unique opportunities for investors. However, it's crucial to thoroughly analyze their financials, growth potential, and fair value before making investment decisions. Each company presents its own set of risks and rewards, and investors should consider their own investment goals and risk tolerance when evaluating these stocks.

WHY YOU SHOULD CHOOSE Etsyshop

WHY YOU SHOULD CHOOSE Etsyshop