Profit from Etsy, Roku & Square Earnings: Invest in COVID-19 Resistant Stocks

Table of Contents:

- Introduction

- Market Overview

- Roku: The Future of Streaming

- Etsy: The Online Marketplace Success Story

- Square: Riding the Fintech Wave

- Q2 2020 Earnings Results

- Growth Prospects and Challenges

- Competitive Landscape

- Investor Considerations

- Conclusion

Introduction

In this article, we will explore three standout companies - Roku, Etsy, and Square - and take a closer look at how they have fared during the coronavirus pandemic. These companies have shown resilience and growth potential in the face of economic uncertainty. We will discuss their respective business models, examine their performance in the market, analyze their Q2 2020 earnings results, evaluate their growth prospects and challenges, and provide insights for potential investors. By the end of this article, you will have a comprehensive understanding of these companies and their potential for future success.

Market Overview

Before diving into the specific companies, let's start with a broad market overview. The US stock market has experienced a strong start to the month of August, with big tech companies leading the way. Tech giants such as Apple, Amazon, and Facebook have showcased their strength, reinforcing the notion that the technology sector is one of the safest and best bets amid the ongoing pandemic-induced downturn. Additionally, the NASDAQ has climbed to new records, indicating positive market sentiment. Despite the challenges posed by the pandemic, there are positive signs emerging, including a decrease in daily COVID-19 cases and gradual recovery in various sectors. Overall, the market outlook for the third quarter is improving, setting the stage for potential growth opportunities.

Roku: The Future of Streaming

Roku, the streaming device and platform company, has witnessed significant growth since its inception. With its small devices that plug into TVs and offer access to a wide range of streaming content, Roku has established itself as a leader in the streaming TV market. The company provides an ecosystem that includes devices, streaming players of different sizes, sound systems, and even its own digital advertising platform. The coronavirus pandemic has further accelerated the shift towards streaming, as millions of people are forced to stay inside. As live sports and movie theaters face restrictions, Roku stands to benefit from the increased demand for streaming services. Despite the challenges brought about by the pandemic, Roku reported impressive Q1 2020 results, with narrower-than-expected losses and significant revenue growth. The company's expansion into international markets and its focus on growing its advertising platform business position it for continued success.

Etsy: The Online Marketplace Success Story

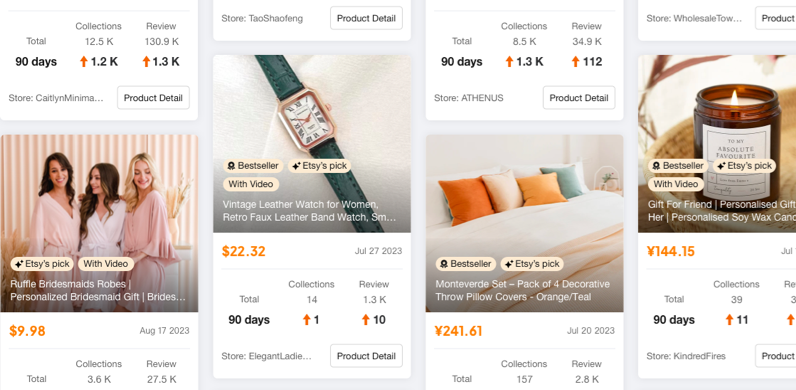

Etsy, an e-commerce marketplace known for its handmade and vintage items, has experienced a surge in its stock price during the pandemic. As people turned to online shopping, Etsy emerged as a go-to platform for individuals and small businesses to sell a wide variety of products. The company's Q1 2020 results showed strong growth in sales, driven in part by the sale of masks amid the pandemic. With millions of masks sold in April alone, Etsy demonstrated its agility in adapting to the evolving market demands. As the e-commerce market continues to grow, Etsy's unique positioning in the online marketplace space gives it a competitive edge. However, the company faces challenges as some of its clients, such as small brick-and-mortar businesses, have been negatively impacted by the pandemic. Despite this, Etsy is expected to report strong Q2 2020 results, and its long-term growth prospects remain promising.

Square: Riding the Fintech Wave

Square, a fintech company, has expanded far beyond its initial credit card readers for micro-sized businesses. Today, Square offers a wide range of point-of-sale solutions, peer-to-peer payment apps, and small business loans. Its Cash App has gained popularity among users, competing against the likes of PayPal and traditional banking giants. While many of Square's clients, particularly small brick-and-mortar businesses, have been negatively affected by the pandemic, the company has seen growth in other areas. The decline in in-store discretionary spending has been partially offset by increased usage of the Cash App. Additionally, Square has reported a surge in direct deposit volumes and a growth in its user base. The company's Q1 2020 results revealed an earnings growth, but also highlighted the impact of the pandemic on small business loan losses. Despite these challenges, Square is expected to report improved Q2 2020 revenues and shows potential for a strong comeback in 2021.

Q2 2020 Earnings Results

The Q2 2020 earnings results of Roku, Etsy, and Square provide valuable insights into their performance during the pandemic. These results reflect the impact of the coronavirus crisis on their respective revenue streams, as well as their ability to adapt to changing market dynamics. By analyzing the financial data and comparing it to expectations and previous performance, investors can gauge the resilience and growth potential of these companies. We will delve into the details of their Q2 2020 earnings, including revenue, earnings per share, and key growth drivers, to provide a comprehensive assessment of their financial health and future prospects.

Growth Prospects and Challenges

As we look ahead, it is important to evaluate the growth prospects and challenges that lie ahead for Roku, Etsy, and Square. While these companies have displayed resilience during the pandemic, they still face uncertainties and potential obstacles in the evolving market landscape. We will examine the factors that contribute to their growth potential, such as the continued expansion of the streaming TV and e-commerce markets, the rise of peer-to-peer payment apps, and the increasing demand for fintech solutions. Additionally, we will discuss the challenges they confront, which include the potential impact of economic uncertainties, competitive pressures, and regulatory scrutiny. By understanding the growth prospects and challenges, investors can make informed decisions about the potential long-term viability of these companies.

Competitive Landscape

The competitive landscape plays a crucial role in the success of any company. We will assess the competitive positioning of Roku, Etsy, and Square within their respective industries. This analysis will include an examination of their competitors, market share, unique selling propositions, and strategies for sustaining a competitive advantage. Understanding the competitive landscape allows investors to evaluate the market dynamics and the ability of these companies to navigate and thrive amidst intense competition. Furthermore, we will highlight any potential disruptive factors that could impact the industry and the market positions of these companies.

Investor Considerations

For investors considering Roku, Etsy, and Square, there are several factors to take into account. We will discuss important considerations such as valuation, growth potential, financial health, and future outlook. By examining these factors, investors can make well-informed decisions about allocating their investments and managing their portfolios. Additionally, we will provide insights into the risk profiles of these companies and offer suggestions for gaining exposure to their potential upside while managing potential downside risks. It is crucial for investors to thoroughly evaluate these companies and align their investment strategies with their individual risk tolerance and investment goals.

Conclusion

In conclusion, Roku, Etsy, and Square have weathered the storm of the coronavirus pandemic and emerged as standout companies in their respective markets. Their ability to adapt to changing market dynamics, capitalize on emerging trends, and demonstrate resilience amidst economic uncertainties positions them for future growth. Despite challenges and uncertainties, these companies offer investors unique investment opportunities within the streaming TV, e-commerce, and fintech sectors. By thoroughly evaluating their growth prospects, financial health, competitive positioning, and investor considerations, investors can make informed decisions about potentially investing in these companies. As the market recovers and the future unfolds, Roku, Etsy, and Square hold promise for both short-term gains and long-term growth.

WHY YOU SHOULD CHOOSE Etsyshop

WHY YOU SHOULD CHOOSE Etsyshop