Is it Worth Investing in Nvidia and Etsy Stock? Find Out Here

Table of Contents

- Introduction

- Market Overview

- Company Profile: Nvidia

- Growth Potential of Nvidia

- Gaming Industry

- Cryptocurrency Mining

- Data Center and Cloud Computing

- Artificial Intelligence and Next-Generation Technology

- Arm Acquisition Deal

- Financial Performance of Nvidia

- Revenue Growth

- Earnings Estimates

- Stock Performance

- Investment Outlook for Nvidia

- Company Profile: Etsy

- Unique Business Model of Etsy

- Growth and Success of Etsy

- Financial Performance of Etsy

- Revenue Growth

- Earnings Estimate

- Stock Performance

- Future Prospects for Etsy

- Comparison of Nvidia and Etsy

- Conclusion

Nvidia and Etsy: Two Tech Stocks Worth Watching Ahead of Earnings Results

The tech industry is always filled with anticipation as companies release their earnings results, and two highly anticipated reports are those of Nvidia and Etsy. In this article, we will delve into the market overview and then focus on the growth potential, financial performance, and investment outlook for each company.

Market Overview

Before diving into the specifics of Nvidia and Etsy, let's take a broader look at the market. Last week, we witnessed a slight slip in the S&P 500 and Nasdaq following their record highs. However, market fundamentals remain strong, with robust earnings results and promising outlooks for 2021. As the vaccination efforts progress, there is hope for a strong economic recovery, particularly in industries hit hard by the pandemic. Additionally, fiscal stimulus measures and the commitment of the Federal Reserve to maintain low interest rates contribute to Wall Street's optimism.

Company Profile: Nvidia

Nvidia, trading under the ticker NVDA, has long been recognized as a leader in the booming gaming industry. The company has capitalized on the growth potential of the video game industry, which is expected to continue thriving in the coming years. Nvidia has also made significant strides in the world of cryptocurrency mining.

A notable aspect that Wall Street has been closely monitoring is Nvidia's expansion within the data center and cloud computing space. The company's impressive Q3 results in this segment, with data center sales up 162%, have contributed to its overall revenue growth. Nvidia has also made significant advancements in the fields of artificial intelligence and other next-generation technologies.

Growth Potential of Nvidia

Gaming Industry

The gaming industry holds immense growth potential for Nvidia. With a reputation as a GPU giant, the company's stock has soared, reaching impressive highs in the past year. Nvidia's ability to innovate and provide cutting-edge gaming technology positions it favorably for continued success in this sector.

Cryptocurrency Mining

In recent years, cryptocurrency mining has emerged as a profitable market. Nvidia has recognized this opportunity and leveraged its technology prowess to tap into the cryptocurrency mining world. By doing so, the company diversifies its revenue streams and maintains a competitive edge.

Data Center and Cloud Computing

Nvidia's achievements in the data center and cloud computing realm have attracted significant attention from investors. The company's Q3 results revealed remarkable growth in this segment, marking a major milestone. As organizations increasingly rely on data centers and cloud computing solutions, Nvidia stands to benefit from this upward trend.

Artificial Intelligence and Next-Generation Technology

Staying ahead of the technological curve, Nvidia has made substantial advancements in artificial intelligence (AI) and other next-generation technologies. The market potential for AI continues to expand, with applications across various industries. Nvidia's involvement in this domain sets a strong foundation for future growth.

Arm Acquisition Deal

In a significant move, Nvidia announced its plan to acquire Arm Limited from SoftBank for about $40 billion. Arm is a pivotal player in the semiconductor industry, and this acquisition could potentially redefine the market landscape. However, securing regulatory approval from the U.S., China, and the UK poses a challenge. Recent reports suggest that obstacles may hinder the deal's progress. Nevertheless, Nvidia's outlook remains robust, irrespective of the outcome.

Financial Performance of Nvidia

Nvidia has demonstrated consistent revenue growth, further fueled by strong fourth-quarter earnings. The company's performance indicates a promising future, especially considering the cyclical nature of the semiconductor business.

Analysts forecast a substantial increase in revenue and bottom-line growth for Nvidia in Q4 of fiscal year 2021. The company's expected revenue growth is around 55%, with projected growth on the bottom line reaching $2.80 per share. For fiscal year 2022, Nvidia is expected to achieve 51% revenue growth and 68% growth on the bottom line.

Looking at the longer-term, Nvidia's Q1 results for 2022 are projected to jump 46% in revenue and 41% on the bottom line. These strong growth figures support the company's return to growth after a slight decline in 2020. Nvidia's performance in the past few years highlights its ability to deliver solid growth, making it an appealing investment option.

Investment Outlook for Nvidia

While Nvidia's valuation may seem stretched, it is not overbought. The relative strength index (RSI) for the stock indicates room for further growth. However, amid the current market volatility and potential near-term selling pressure, cautious investors may choose to wait for Nvidia's actual results and guidance before making investment decisions. It is essential to consider market dynamics and broader trends to ensure optimal investment outcomes.

Company Profile: Etsy

In a domain separate from Nvidia, Etsy operates a unique business model as an e-commerce marketplace. Considered as an arts and crafts fair-style platform, Etsy stands out amidst the competition. The company has witnessed exceptional growth, rivaling the success of established e-commerce giants like Shopify and Zoom Video.

Unique Business Model of Etsy

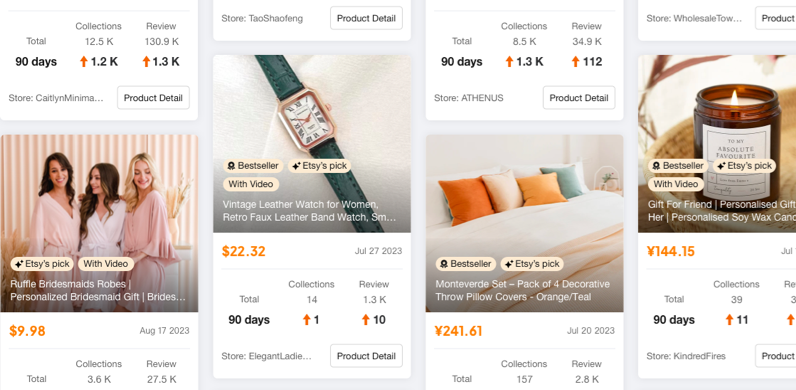

Etsy provides an online marketplace for individuals, entrepreneurs, small businesses, and artisans to sell a wide range of products, including clothing, jewelry, art, and home decor. With roots tracing back to 2005, the company went public in 2015. In addition to its core marketplace, Etsy also acquired a musical instrument marketplace, broadening its reach in niche markets.

Growth and Success of Etsy

Etsy's growth story is remarkable, with back-to-back quarters demonstrating substantial revenue growth. During the pandemic, consumers flocked to digital channels, pushing entrepreneurs and small businesses to embrace e-commerce. Etsy's focus on unique, handmade, and personalized products attracted a considerable customer base, distinguishing itself from the likes of Amazon and eBay.

In the last quarter, Etsy witnessed a 42% increase in active sellers, reaching approximately 3.7 million. Active buyers also surged by 55% to around 70 million. The company's gross merchandise sales skyrocketed by 120%, generating approximately $2.6 billion in Q3 revenue—a 130% increase compared to Q2. Although face mask sales contributed significantly, even excluding them, Etsy achieved a remarkable 93% growth in gross merchandise sales.

Financial Performance of Etsy

Etsy's fiscal 2020 revenue is expected to jump approximately 100% to about $1.63 billion, accompanied by an estimated 182% increase in adjusted earnings. The company has consistently surpassed our earnings and revenue estimates in recent quarters. However, the nature of the pandemic's impact on sales creates challenges in projecting future growth rates.

Although Etsy has enjoyed remarkable success, its forward sales multiple is relatively low, trading at approximately 15 times forward 12-month sales. Comparing this valuation to industry peers like Shopify, which trades at about 43 times forward sales, indicates potential for further growth.

Future Prospects for Etsy

Etsy's future performance is contingent upon multiple factors, including how consumer behavior evolves post-pandemic. As vaccines become more widespread, the surge in online sales may slow down as people return to in-person shopping experiences. It will be essential to monitor how Etsy adapts to changing market dynamics and sustains its growth trajectory.

Comparison of Nvidia and Etsy

In evaluating both Nvidia and Etsy, it is clear that these companies operate in vastly different sectors. Nvidia's success is tied to emerging technologies, such as gaming, cryptocurrency mining, and AI, while Etsy thrives as an e-commerce marketplace specializing in unique, handmade products.

Investors seeking exposure to the tech industry can find potential in both companies. Nvidia's strong financial performance and ongoing innovations position it as a leader in promising tech sectors. On the other hand, Etsy's unique position and exceptional growth highlight its ability to capture market share in a highly competitive landscape.

Conclusion

As we approach the earnings reports for Nvidia and Etsy, the anticipation builds. Both companies have displayed tremendous growth potential, solid financial performance, and attractive investment prospects. However, it is essential to consider the current market volatility and potential near-term selling pressure impacting the tech sector. Investors should carefully analyze the results and guidance provided by Nvidia and Etsy, taking into account their long-term investment objectives and risk tolerance.

WHY YOU SHOULD CHOOSE Etsyshop

WHY YOU SHOULD CHOOSE Etsyshop