Boost Your Income with YouTube & Etsy Side Hustle

Table of Contents

- Introduction

- Stuffing Cash Envelopes for Side Hustle Income

- Business Expenses

- Priorities: Student Loans

- Seasonal Activities

- Moving Fees

- Sinking Funds: Yellow Binder

- Cash Envelopes for Other Expenses

- Books

- Close

- Date Night

- Electronics

- Fitness and Wellness

- Gas

- Giving

- Going Out

- Household

- Medical

- Self Care

- Spending

- Black Friday Sale and Haul

- Upcoming 2022 Dated Budget Book

Stuffing Cash Envelopes for Side Hustle Income

Introduction

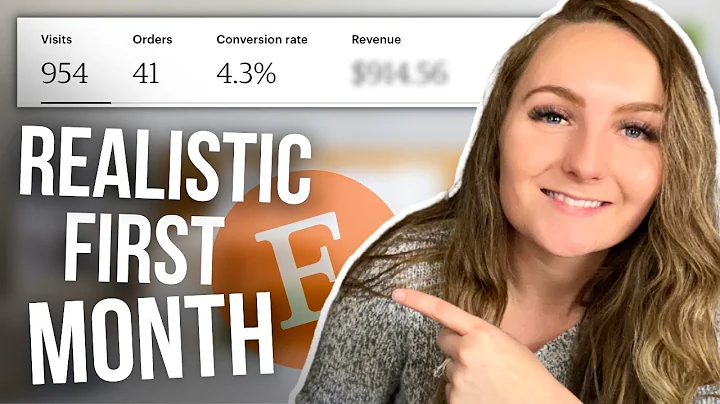

Welcome back to my channel! In today's video, I will be sharing my cash envelope stuffing routine for the fourth week of November. This week, I will be focusing on stuffing my cash envelopes with the income I earned from my side hustles, including my Etsy shop and YouTube channel. I received a payment of $491 from Etsy and $526 from my October YouTube paycheck, totaling $1,017. Join me as I count and distribute this income into various budget categories to stay organized and on top of my expenses.

1. Business Expenses

As always, I start by allocating funds for my business expenses. Today, I will set aside $30 for taxes, which I've calculated to be $305. This amount will go towards my quarterly tax obligations. I carefully place three $100 bills and a $5 bill into the tax envelope, bringing the total to $305. With this addition, my bank balance for business expenses now stands at $4,000. I also account for the $5,149 I've accumulated over time for taxes, which I find quite astounding. It's incredible how these expenses can add up, but I am prepared to manage them.

In preparation for Black Friday, I allocate $40 for business expenses related to the anticipated sales. Additionally, I set aside $200 for equipment purchases, which I plan to buy in twenties. After counting, I have a total of $762 in the equipment envelope. Shipping, office supplies, marketing, and bills remain unchanged today, with $283, $63, $75, and $20, respectively.

2. Priorities: Student Loans

Moving on to my top priority, I allocate $200 towards my student loans. I neatly arrange twenty-dollar bills, creating a total of $1,000 in this envelope. With this addition, the bank balance for my student loans amounts to $1,875. It feels great to see this debt steadily decreasing and knowing that I am making progress towards financial freedom.

3. Seasonal Activities

In anticipation of winter, I allocate $5 to the seasonal activities envelope. This envelope will cover any expenses related to winter-themed outings or activities. I place the bill inside, and the total for seasonal activities reaches $65. I can't wait to enjoy the winter season and make the most of the activities I have planned.

4. Moving Fees

Next, I allocate $20 to the moving fees envelope. This envelope serves as a sinking fund to cover any costs associated with moving, such as hiring movers or purchasing packing supplies. With this addition, the moving fees envelope reaches a total of $175. It's important to have this fund ready in case I decide to relocate or need to cover unforeseen moving costs.

5. Sinking Funds: Yellow Binder

Moving on to my yellow sinking funds binder, I make some adjustments. I allocate an additional $20 to the family category, which brings the total to $40. While this category is currently depleted, I am working towards replenishing it soon. Next, I set aside $15 for New Year's Eve. This amount, combined with the existing balance of $80, results in a total of $95. I am excited to celebrate the upcoming new year and make it a memorable one.

Skipping the future category for now, I proceed to the holidays section. I allocated $40 for birthdays, realizing that I still haven't spent anything from this envelope. However, I decide to add $20 to the fund today, bringing it to a total of $60. This will allow me to plan and celebrate birthdays with my loved ones without any financial stress.

6. Cash Envelopes for Other Expenses

Now let's move on to my cash envelopes for various other expenses. I will briefly go through each envelope and highlight any changes:

-

Books: No changes today. The envelope contains $12, which will go towards purchasing books that I have been looking forward to reading.

-

Close: I allocate $10 to this envelope, bringing the total to $102. This envelope serves as a fund for any clothing or wardrobe needs that may arise.

-

Date Night: Today, I used $10 from this envelope for a special date with my partner. As a result, there is now $15 remaining in this envelope.

-

Electronics: No changes today. This envelope contains $175, which will go towards any electronic gadgets or accessories I plan to purchase in the future.

-

Fitness and Wellness: No changes today. This envelope contains $11, which I will utilize for any fitness or self-care-related expenses.

-

Gas: No changes today. The envelope holds $39 and will cover my fuel expenses for the foreseeable future.

-

Giving: I allocate $1 to this envelope today, which increases the total to $15. It's important for me to give back to others and support causes that align with my values.

-

Going Out: No changes today. This envelope contains $102, providing me with funds for entertainment and dining out.

-

Household: No changes today. The envelope contains $37, which will cover any household expenses or small purchases for my living space.

-

Medical: I decide to skip funding this envelope today. It currently holds $341, which provides a buffer for any unexpected medical expenses.

-

Self Care: I set aside $10 for self-care expenses, increasing the total envelope balance to $56. It's crucial to prioritize self-care and ensure that I am taking care of my physical and mental well-being.

-

Spending: No changes today. The envelope contains a $25 Amazon gift card and $16 in cash, allowing me to make discretionary purchases as needed.

7. Black Friday Sale and Haul

As mentioned earlier, I am excited to announce a Black Friday sale in my Etsy shop. From Black Friday until Cyber Monday, customers will enjoy a blanket discount of 20% off on all items. No coupon code is required, making it easy for shoppers to take advantage of the sale. I encourage everyone to visit my shop and stock up on items they've had their eye on. In addition to this sale, I will be sharing a Black Friday haul in a future video, showcasing the items I purchased during this shopping event.

8. Upcoming 2022 Dated Budget Book

Lastly, I want to inform my viewers about the upcoming release of my 2022 dated budget book. This comprehensive resource will be available in both digital and printable formats, covering the entire year from January to December. While I'm still finalizing the exact release date, I anticipate it to be soon. As a special offer, there will be a one-day 20% off sale on the budget book once it is launched. This is a great opportunity for anyone interested in organizing their finances for the upcoming year. Stay tuned for more updates on this exciting release.

In conclusion, today's cash envelope stuffing session focused on allocating my side hustle income into various budget categories. I took care of my business expenses, prioritized my student loans, and distributed funds to sinking funds and cash envelopes for other discretionary expenses. Additionally, I shared exciting news about the upcoming Black Friday sale in my Etsy shop and the release of my 2022 dated budget book. Remember to take advantage of the sale and stay tuned for more updates. Thank you for joining me today, and I'll see you in the next video!

Highlights

- Stuffing cash envelopes for side hustle income

- Allocation of funds for business expenses and taxes

- Top priority: reducing student loan debt

- Setting aside funds for seasonal activities and moving fees

- Updating sinking funds for various expenses

- Exciting Black Friday sale in the Etsy shop

- Upcoming release of the 2022 dated budget book

FAQ

Q: How often do you stuff your cash envelopes?

A: I stuff my cash envelopes on a weekly basis, typically towards the end of the month.

Q: Can you provide more details about your Etsy shop?

A: My Etsy shop offers a wide range of products, including budgeting and organizational tools, digital planners, printable resources, and more. It's a one-stop shop for anyone looking to improve their financial management and productivity.

Q: How do you determine the allocation of funds for each budget category?

A: I allocate funds based on my personal financial goals and priorities. I set aside a certain percentage of my income for essential expenses, savings, debt payments, and discretionary spending. The specific amounts may vary from month to month, depending on my needs and financial circumstances.

WHY YOU SHOULD CHOOSE Etsyshop

WHY YOU SHOULD CHOOSE Etsyshop