Maximize Your Success on Etsy with These 6 Essential Steps

Table of Contents:

- Introduction

- Making Your Etsy Store Official

- Financial Planning for Your Etsy Store

- The Importance of Bookkeeping

- Researching Niches and Trends on Etsy

- Free Courses and Resources

- Conclusion

Article: How to Maximize Your Success on Etsy

Introduction

Welcome to my channel, where I share valuable advice and tips for running a successful Etsy store. If I had the chance to go back in time and give myself advice before starting my store, there are a few key steps I would have taken. In this article, I'll share those steps with you in the hopes that they will help you as much as I wish they had helped me when I started my own Etsy store.

- Making Your Etsy Store Official

The first step I would have taken before even opening my Etsy store is to make it official. This means taking the necessary legal steps to start your own Etsy account. You can do this by opening a DBA (Doing Business As) or an LLC (Limited Liability Company) underneath your Etsy store name. Registering a DBA can usually be done with your local state government or online. Alternatively, you can opt for the additional tax benefits that come with starting an LLC. I recommend watching my video on this topic for a more detailed comparison between a DBA and an LLC.

Pros: Establishing your Etsy store as an official business entity can provide legal protection and tax benefits.

Cons: Registering a DBA or an LLC may involve some paperwork and additional costs.

- Financial Planning for Your Etsy Store

Thinking ahead financially and avoiding future stress is crucial when starting an Etsy store. To accomplish this, there are a few steps you should take. First, open a business credit card, a business checking account, and two business savings accounts. By separating your personal and business finances from the start, you can avoid confusion and streamline your bookkeeping process. It is essential to have a record of your expenses, production costs, and profit and loss numbers for tax purposes. Opening a business checking account may require proof of your business registration, such as a DBA or LLC. Ensure you register your business with your state before proceeding with these financial steps.

Pros: Separating personal and business finances makes bookkeeping more organized and simplifies tax filing.

Cons: Opening business accounts may involve some initial setup and paperwork.

- The Importance of Bookkeeping

One of the biggest regrets I had when starting my Etsy store was not hiring a bookkeeper sooner. I suggest getting a bookkeeper once you reach around 100 sales on Etsy or a few months into running your store. Keeping track of your books and reconciling them before the end of the year is essential. Understanding your production costs, profits, and losses is crucial for accurate tax reporting. Having a second set of eyes on your books ensures their accuracy and helps you avoid errors that could potentially lead to audits. Using tools like QuickBooks Online can simplify the bookkeeping process by automatically importing your Etsy transactions and production costs from print-on-demand providers.

Pros: Hiring a bookkeeper ensures accurate and up-to-date bookkeeping, reducing stress during tax season.

Cons: Hiring a bookkeeper may involve additional costs, but it is an investment that saves time and potential errors.

- Researching Niches and Trends on Etsy

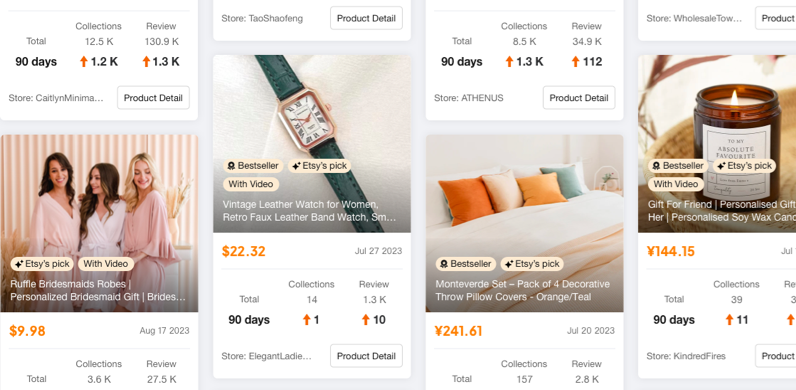

Before posting listings on Etsy, it is essential to conduct thorough market research. When I started, I made the mistake of uploading listings in generic niches without considering trends and competition. To succeed on Etsy, you must identify specific niches and designs that resonate with your target audience. Pay attention to what other successful sellers are doing and study the design trends on the platform. Being ahead of the game and starting your trends can give you a competitive advantage. Additionally, consider offering products beyond t-shirts and sweatshirts. Exploring unsaturated categories can create new opportunities for your Etsy store.

Pros: Conducting market research helps you find profitable niches and enables you to stay ahead of trends.

Cons: Market research requires time and effort, but the rewards can be significant in terms of increased sales and visibility.

- Free Courses and Resources

To help you further in your Etsy journey, I offer free courses that cover the basics of print-on-demand and Etsy. These courses provide valuable insights into researching trends, designing unique products, and finding unsaturated categories. By enrolling in these courses, you can gain the knowledge and skills needed to maximize your success on Etsy. I also recommend checking out my free print-on-demand and Etsy crash course, which delves deeper into the intricacies of running a thriving Etsy store.

Pros: Free courses and resources provide valuable information and guidance for starting and growing your Etsy store.

Cons: Accessing additional courses and resources may require sign-up or registration.

- Conclusion

In conclusion, maximizing your success on Etsy involves taking the necessary steps to make your store official, planning your finances, prioritizing bookkeeping, and conducting thorough market research. By following these steps, you can set a solid foundation for your Etsy store and increase your chances of achieving long-term success. Remember to use the available resources and courses to enhance your knowledge and stay updated with the latest trends and strategies. Good luck on your Etsy journey!

Highlights:

- Establish your Etsy store as an official business entity for legal protection and tax benefits.

- Separate your personal and business finances to simplify bookkeeping and tax filing.

- Hire a bookkeeper to ensure accurate and up-to-date financial records.

- Conduct thorough market research to identify profitable niches and design trends.

- Take advantage of free courses and resources to enhance your Etsy store's growth.

FAQ

Q: Is it necessary to register a DBA or LLC for an Etsy store?

A: While not mandatory, it is highly recommended to register your Etsy store as an official business entity to enjoy legal protection and tax benefits.

Q: When should I consider hiring a bookkeeper for my Etsy store?

A: It is advisable to hire a bookkeeper when you reach around 100 sales on Etsy or a few months into running your store to keep your books accurate and up to date.

Q: How can I conduct market research for my Etsy store?

A: Research successful sellers, study design trends, and identify unsaturated categories through platforms like Etsy itself or external resources.

Q: Can I access the free courses and resources mentioned in the article?

A: Yes, the provided links in the article will direct you to the free courses and resources that cover various aspects of running a successful Etsy store.